- Synthetic

- Posts

- From Model Wars to World Models

From Model Wars to World Models

How 2025 Set the Stage for AI’s Next Leap 🚀

Welcome to a special end-of-year edition of Synthetic. The newsletter took a break for the latter half of the year so we could focus on another couple of big projects—a nine-hour AI video training course for business leaders, and a new book, “The AI Ultimatum: Preparing for a World of Intelligent Machines and Radical Transformation.”

With those two now successfully launched, Synthetic will return to your inboxes in the New Year, to keep you up to date on all things AI.

Here’s a wrap up on the significant happenings of 2025 and some thoughts on where things will go next in 2026. Happy New Year everybody! Best wishes for an amazing 2026, Steve and the Synthetic team. |  |

Wow, what a year it’s been. Twelve months of ever-expanding intelligence, breathtaking capital investments, exciting new capabilities, and rising uncertainty about the future. In this post, I’ll summarize the more significant events of 2025 and share my thoughts on what we should expect in ’26. If you thought 2025 was incredible, I suspect the coming year has a lot more in store for us all!

Battle of the Models

As New Year’s hangovers subsided, we began 2025 with OpenAI’s GPT-4 as the world’s most capable AI model. It’s incredible how far we have come since then, as the frontier labs leapfrogged each other in a constant battle to claim and reclaim the crown as the most intelligent model. Here’s how it played out:

In January, China’s DeepSeek launched R1. This impressive open-source reasoning model shook financial markets, wiping more than $1 trillion off the market caps of leading tech stocks. It all came back, and then some. As I predicted here in Synthetic, the techniques were quickly applied to other models, accelerating AI progress and only increasing the hunger for computing capacity. A week later, Alibaba launched Qwen 2.5-Max, a model that posted strong benchmarks, not taking the crown but establishing that China is a serious contender in the AI race. In late March, DeepSeek V3 would have wrested the lead from GPT-4 if it hadn’t been for Google previewing Gemini 2.5 Pro the same day. Gemini 2.5 Pro was positioned as “state-of-the-art on key math and science benchmarks.” It also made significant advances in multimodality and in the use of a massive context window.

Anthropic’s Claude Opus 4, released in May, was widely considered the best model for coding. Still, Gemini 2.5 Pro (made broadly available in June) held the lead on most benchmarks until July, when Elon Musk’s xAI released Grok 4, claiming it was the “most intelligent model in the world.” Team Elon held the crown for just a few weeks before OpenAI released its long-awaited GPT-5, which took the lead but was widely considered underwhelming relative to expectations. GPT-5 and then GPT 5.1 held the lead until last month, when Google seized the crown with its impressive Gemini 3 Pro model, which grabbed headlines and received praise worldwide. A week later, Anthropic dropped Claude Opus 4.5, considered the best model for coding, showing that it remains a very viable contender in what could easily become a three-way race between Google, OpenAI, and China. It’s been widely reported that Sam Altman issued a “code red” to OpenAI employees and was forced to accelerate the release of GPT 5.2 to keep OpenAI in the game. In some ways, delivering GPT 5.2 mortgages OpenAI’s future, since it requires more compute capacity than 5.1 and is rumored to be eating into the computing power available to OpenAI researchers, limiting their ability to conduct research and train new models. As we end the year, Google’s new Gemini 3 Flash, a super-fast, distilled version of Gemini 3, is now deployed across all Google products and services. A version of Gemini 3 flash will likely power Apple Intelligence features next year, including the long-awaited new Siri experience.

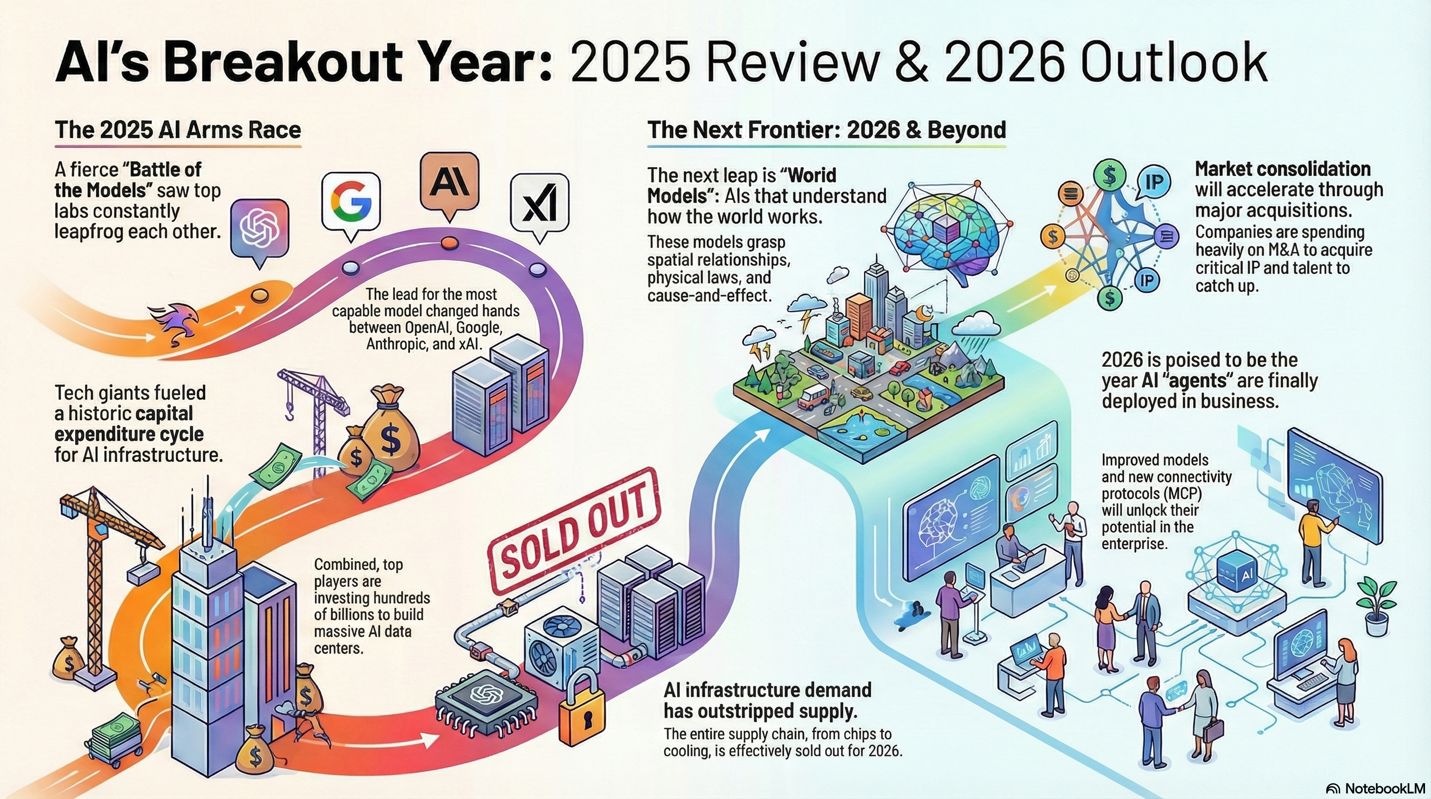

Models didn’t just get smarter in 2025, with better reasoning; they also became more multimodal, able to handle text, speech, music, images, charts, infographics, audio, and video. At the beginning of the year, AI-generated videos were distorted and clearly AI-generated. Now, most people are hard-pressed to distinguish between real and AI-generated video. Advances to ChatGPT’s image engine and the release of Google’s Nano Banana Pro have elevated image generation to a new level. Nano Banana Pro’s ability to create detailed infographics is astonishing. Incidentally, here’s the infographic version of this article, created by NotebookLM:

This model race won’t abate in 2026. The New Year is expected to bring Grok 5, Claude 5, and a new OpenAI model architecture called “Project Garlic,” which is expected to beat Gemini 3 and Opus 4.5 on coding and reasoning benchmarks. Whether it’ll be named GPT-5.5, GPT-6, or something new, nobody knows. Expect Google to respond in force. One thing is for sure… 2026 will not be a dull year in AI.

What comes next are world models, AI models that understand how the world works: spatial understanding of objects and their relationships; physical laws like gravity and fluid dynamics; perspective, occlusion, and object permanence, and most importantly…cause and effect. Google DeepMind’s SIMA 2 is a step in this direction, generating realistic, explorable, interactive worlds on the fly from a prompt. To some extent, video generation models must have an innate understanding of how the world works to generate realistic scenes of waterfalls, race cars, and people. DeepMind’s Project Astra uses a smartphone’s camera to understand a user’s context and provide valuable insights, demonstrating an understanding of the world and how it works. Google has packaged early Project Astra features as Gemini Live, and anyone can now try it for free. I expect Google to make the most rapid progress here in 2026 as it combines capabilities from SIMA, Project Astra, and VEO 3.1 to create early world models.

Race for Capacity

Having the best model and the ability to deliver it to users at scale requires substantial investment in AI data center infrastructure.

In 2025, the AI data center land grab fueled one of the largest capex cycles in modern tech history. The headline numbers are staggering. Amazon guided to ~$125B in full-year capex (and said it expects more in 2026) as AWS races to add AI capacity. Alphabet raised its 2025 capex plan to $91–$93B and explicitly signaled that 2026 will be even bigger, reflecting how power, land, and GPUs have become the binding constraints on growth. Meta lifted its 2025 capex range to $70–$72B and said capex will rise significantly in 2026 as it “aggressively” builds AI datacenter capacity. CEO Mark Zuckerberg has said he’s far more worried about the dangers of under-investing in infrastructure than overinvesting. Microsoft, meanwhile, said it was on track to invest ~$80B in FY2025 to build AI-enabled data centers for training and cloud deployment—an unusually direct, single-line statement of intent that underscores how central compute has become to its product strategy. Across these players, the common theme is that the “default plan” is no longer incremental buildout—it’s industrial-scale infrastructure, paired with forward guidance that spending stays elevated (or rises) for as long as demand holds.

OpenAI sits at the center of this cycle because its compute appetite effectively sets the pace for the ecosystem. Stargate, OpenAI’s mammoth infrastructure project in partnership with Oracle and SoftBank, outlined a commitment of up to $500B and 10 gigawatts of AI data-center capacity by the end of 2025. It’s unclear whether OpenAI met its goals, but in September, the company claimed it was ahead of schedule. OpenAI has also described additional large-scale capacity agreements with Oracle. That dynamic is also why Oracle has become the market’s cautionary tale: investors initially rewarded Oracle’s AI pivot (shares surged earlier in 2025), but sentiment swung sharply as analysts and credit markets focused on debt and cash burn tied to building out capacity for OpenAI—concerns that surfaced repeatedly as Oracle raised spending expectations and then saw the stock drop amid forecasts and capex shock. Total capex spending by the big five—Meta, Microsoft, Google, Oracle, and Amazon—for 2025 will exceed $400 billion, or more than $1 billion per day.

In 2026, expect AI data center investment to accelerate. Unless there’s a major reset (e.g., China craters the market by flooding it with cheap, open-source models that are judged ‘good enough’ by enterprise users), the whole infrastructure industry—from gas turbine suppliers and chip makers to companies making copper wiring and cooling solutions—is effectively SOLD OUT for 2026. This effort is now limited by supply, not demand.

2025 Acquisitions May Be Dwarfed By 2026

This year saw significant acquisitions in the AI sector. After disappointing the market with its Llama 4 models and its maligned “Vibes” video feature, Meta has shifted into serious catch-up mode. It bought Scale AI and Manus and went on a hiring spree, reportedly offering nine-figure salary packages to leading AI researchers as it seeks to build a superintelligence team. Apple Intelligence has so far been a colossal disappointment—Its image-generation tech is still crap, at least two years behind, and its summarization features are, well, functional at best. Senior heads rolled, and the new Siri experience was delayed by a year. It’s rumored that Google will come to the rescue with a custom version of Gemini integrated into Apple Intelligence and the all-new Siri sometime this Spring. Meanwhile, the whole industry is waiting to see what new AI-first device the merger of OpenAI and Jony Ive’s io design company will yield.

NVIDIA's purchase of Groq’s inference IP was 2025’s best AI business move. Jensen Huang spent $20 billion to strengthen his company’s lead by licensing Groq's tech and hiring 90% of its talent. It’s rumored that Groq’s technology will appear in NVIDIA’s 2028 hardware platform, codenamed Feynman, and will be used both to deliver rapid inference (essential for voice agents and other real-time applications) and to accelerate the training of reasoning models using reinforcement learning. Amid some big IPOs (Anthropic and OpenAI are both expected to go public next year), expect more acquisitions in 2026 as the market consolidates, and companies with deep pockets (I’m talking about you, Amazon, Meta, and Apple) spend money to acquire IP and talent as they strive to catch up. NVIDIA will likely acquire more complementary IP and talent and is rumored to pick up Israel’s AI21 Labs soon. ServiceNow and other SaaS companies will be in a buying mood as they build out their agentic capabilities, and a big consumer brand could acquire robotics leader, Figure (Apple?) And don’t be surprised if we see more M&A activity in the infrastructure layer involving companies like CoreWeave, Crusoe, Nebius, and Lambda Labs.

AI Ecosystems Are Forming

The big players are building out ecosystems to create additional value around their core AI platforms. Google is frantically embedding Gemini across every consumer-facing surface it has—from search and Gmail to Google Maps and new AI experiences like the incredible NotebookLM.

OpenAI doesn’t have Google’s reach, so it’s trying to position itself as an operating system of sorts. In October, it announced app partnerships with Uber, Instacart, Figma, Coursera, Spotify, Zillow, Canva, Expedia, and others, giving users access to these platforms from within ChatGPT. OpenAI also added social features, including Group Chat, and its consumer video generation platform, Sora 2. Expect more ecosystem building in 2026, with OpenAI adding more app partnerships

To Bubble or Not to Bubble

The data center construction frenzy and perceptions of circular trades in the AI sector have raised concerns about an AI bubble. But let’s dissect that for a moment.

Are startups that wrap a thin layer of value around frontier models and earn multi-billion-dollar valuations in a bubble? Of course they are. Is NVIDIA overvalued because AI infrastructure is overbuilt, and its demand is about to crater? Unlikely.

The hyperscalers can’t get enough of NVIDIA’s GPUs. NVIDIA is sold out. Their rivals are mostly sold out as data center builders grab whatever they can from AMD, Broadcom, and others. Chip companies and foundries will likely remain sold out for years to come. Do the hyperscalers enjoy paying such high prices for NVIDIA technology, sold at a 75% margin? Of course they don’t. And they all have hardware projects designed to offer an alternative: Google’s TPUs, Amazon’s Tranium line, and so on. Will these me-too projects deliver the performance per watt or tokens per dollar throughput that NVIDIA’s best platforms can offer? Unlikely anytime soon.

At the end of the day, it all comes down to who can secure leading-edge capacity at the chip foundries. NVIDIA has locked up a sizeable chunk of TSMC’s 2nm wafer starts for its future products. The open question for 2026: which of the AI chip players will announce partnerships with Intel for their 18A and 14A production processes? In a world where you take anything you can get to remain relevant, there’s room for everyone to sell something. I expect Intel’s foundry business to see a nice bump in ’26 and ‘27 and expect non-NVIDIA silicon companies to do well, too.

Some ‘bubblesayers’ point to circular trading in the AI industry, noting that similar behavior was observed among internet companies before the dot-com bubble burst. There’s a big difference between internet companies creating false demand and Jensen Huang allowing Sam Altman to buy GPUs with equity rather than dollars, which is what happened when NVIDIA took OpenAI’s payments for GPUs and reinvested them directly into OpenAI stock. This isn’t circular trading; it’s NVIDIA acting as a smart VC, and Sam Altman making the tough decision to give up equity for the chips OpenAI so desperately needs.

What happens next?

2025 was an incredible year, but it was just the warm-up. Next year is the real game, where things get real, and AI’s impact will be felt everywhere. AI will become more spatial, more agentic, more physical, and better at understanding the world.

This year was billed by many as “the year of agents.” Well, that didn’t happen, and for several reasons:

1) The core technology wasn’t ready—AI just wasn’t reliable enough to deploy broadly across the enterprise. The latest models are impressive, fast, and when grounded in company data using RAG or MCP, far more reliable than anything you could achieve just three months ago.

2) Agentic connectivity is still emerging—think of MCP (Model Context Protocol) as the ‘USB of agents,’ connecting agentic AI to legacy systems (CRM, ERP, email, etc.), tools (search, weather, calculators, etc.), file systems, data, and other enterprise capabilities. Software vendors have been slow to add MCP support to their platforms, stunting the promise of agents in 2025. Salesforce is in the lead with MCP support, but SAP, Oracle, Microsoft, and Workday are either in early preview, have limited support, or are in ‘promise’ mode. This should all get fixed in 2026.

3) The hard work of determining where agents can and should complement human effort in workflows has yet to be properly mapped and planned. This will become a significant responsibility for middle management in 2026 and 2027.

As these three pieces fall into place, businesses will begin to trial agentic solutions in parts of their operations. If 2025 was the year everyone started talking about agents, 2026 will be the year they start being deployed. Eager startups will build specific agents to solve particular business problems. At least for the first few years, agents will be specialists, tuned to do one task well. It’ll be a while longer (perhaps when we get AGI) before agents become jack-of-all-trades and more general in nature.

Spatial AI and world models will continue to make AI more useful—enabling machines to understand the 3D world and advancing the abilities of AI assistants and robots. Expect 2026 to bring new spatial-AI-powered glasses and ever more impressive humanoid robotics demos. If 2025 was the year we saw humanoid robots load the dishwasher and fold laundry, 2026 might be the year we see a robot cook a meal and do simple yard work.

In summary

Whether you are a casual observer or an avid analyst of the AI world, 2025 was an impressive year. Intelligence is rising rapidly as the cost of that intelligence plummets exponentially. The hardware (data centers) and software infrastructure (MCP and A2A) are falling into place, ready for a ramp of agentic AI capabilities. In 2026, robotics startup 1X will begin shipping its NEO Gamma humanoid robot into homes for just $20,000. You can pre-order one right now. And we may be just one or two algorithmic breakthroughs away from human-level Artificial General Intelligence (AGI).

The race is on. Don’t get left behind.